WazirX Cyberattack Triggers Socialized Loss Strategy

WazirX users have been given two options to manage their remaining assets, with specific benefits and conditions outlined on the WazirX app and website.

Samiksha Jain July 28, 2024

Share on LinkedInShare on Twitter

Indian cryptocurrency exchange WazirX has announced a comprehensive plan to restore operations and enable user access to funds. The WazirX cyberattack, which resulted in losses exceeding $230 million—or roughly 45% of user funds—has prompted WazirX to implement a socialized loss strategy, aiming to distribute the financial impact equitably across its user base.

WazirX’s official notice details the 55/45 approach, where 55% of users’ crypto assets will be accessible for trading or withdrawal, while the remaining 45% will be converted to USDT-equivalent tokens and locked.

“We are implementing a fair and transparent socialized loss strategy to distribute the impact across all users equitably,” the exchange stated.

A Balanced Approach to WazirX Cyberattack Loss Distribution

This method offers a faster, more flexible solution compared to traditional proceedings, allowing immediate access to a significant portion of assets while maintaining the possibility of further recovery to WazirX cyberattack.

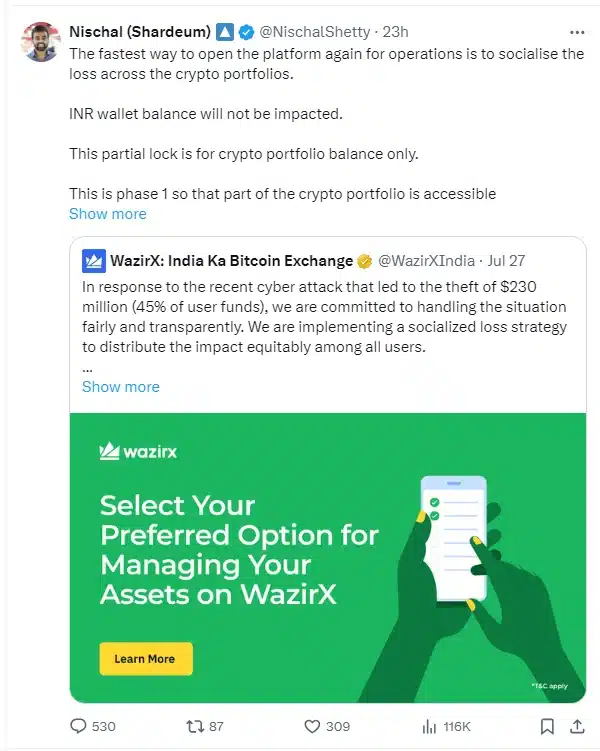

Co-founder Nischal Shetty emphasized this approach on Twitter, stating, “The fastest way to open the platform again for operations is to socialize the loss across the crypto portfolios. INR wallet balance will not be impacted. This partial lock is for crypto portfolio balance only. This is phase 1 so that part of the crypto portfolio is accessible to everyone.”

Source: X

Shetty assured users that the current measures are just the beginning. “This is not the end. This is the start of phase 2 where we work on recovery,” he explained. The recovery phase will include efforts to trace and recover stolen assets, partnerships for external help, airdrops, new token use cases, and potentially using future profits to fill the gap.

“By socializing the loss similar to how other impacted exchanges have done in the past, we are in a position to open up the platform sooner for everyone,” he added.

Source: X

User Options and Portfolio Management

WazirX users have been given two options to manage their remaining assets, with specific benefits and conditions outlined on the WazirX app and website. The key points include:

Distribution of Funds: 55% of user crypto assets will be available for trading or withdrawal, while 45% will be converted to USDT-equivalent tokens and locked.

Balanced Portfolio: The 55% accessible portion will be balanced using a basket of unaffected crypto assets available on the platform.

Recovery Efforts: Ongoing efforts will focus on recovering the stolen funds, exploring options like airdrops, and other emerging ideas.

Portfolio Valuation: The value of the unlocked portfolio (55%) will be calculated based on average prices from CoinMarketCap and select global exchanges as of July 21, 2024, 8:30 PM IST.

Resumption of Operations: Operations will resume shortly after the poll, which will help guide the final decision-making process.

Registered users will receive an email with detailed instructions and a link to WazirX, where they can select their preferred option. The deadline for responses is August 3, 2024, 7:00 AM IST. The poll is not legally binding, but it will influence the final decision along with ongoing investigations, the platform’s liquidity, and other evolving circumstances. By participating, users agree to the poll’s terms and the WazirX Terms of Use.

Key Considerations for Crypto and INR Holdings

- Impact on Different Crypto Holdings: The 55% unlocking and 45% locking will apply proportionally to each crypto in a user’s portfolio. For portfolios with entirely stolen tokens, 55% will be replaced with other tokens of equivalent value.

- INR Holdings: INR wallet balances will not be affected, and users with only INR holdings do not need to participate in the poll.

- Mixed Portfolios: For mixed portfolios of INR and crypto, INR funds will remain fully accessible, while the 55/45 approach will apply to the crypto holdings.

- Locked Tokens: Unlocking of locked tokens will depend on ongoing recovery efforts, including tracing stolen assets and exploring compensation methods.

The recent cyberattack on WazirX has posed significant challenges for the company and its users, but the exchange is committed to addressing these issues with transparency and fairness. Users’ input and support are crucial as WazirX navigates this period and works towards restoring full functionality.