Evolve Bank Data Breach: Customer Information Exposed

Evolve Bank & Trust has confirmed that its debit cards, and online, and digital banking credentials have not been compromised in the incident and remain secure.

Samiksha Jain June 27, 2024

Share on LinkedInShare on Twitter

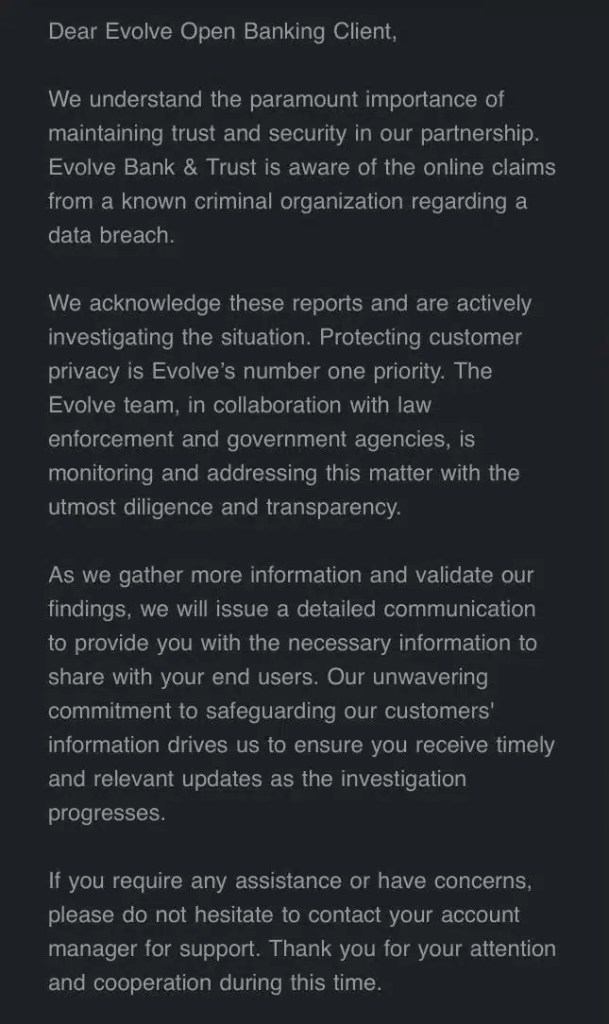

Evolve Bank & Trust disclosed that it has been the target of a cybersecurity incident. In a statement, the bank confirmed that customers’ personal information had been illegally obtained and released on the dark web by cybercriminals. This Evolve Bank data breach affected both retail bank customers and the customers of Evolve’s financial technology partners.

The Evolve Bank data breach involved a known cybercriminal organization that illegally obtained and published sensitive information. The stolen data includes Personal Identification Information (PII) such as names, Social Security Numbers, dates of birth, account details, and other personal information.

“Evolve is currently investigating a cybersecurity incident involving a known cybercriminal organization that appears to have illegally obtained and released on the dark web the data and personal information of some Evolve retail bank customers and financial technology partners’ customers (end users),” reads the official statement.

Evolve Bank & Trust has confirmed that its debit cards, and online, and digital banking credentials have not been compromised in the incident and remain secure.

“Evolve has engaged the appropriate law enforcement authorities to aid in our investigation and response efforts. Based on what our investigation has found and what we know at this time, we are confident this incident has been contained and there is no ongoing threat,” reads the official statement.

Details of the Evolve Bank Data Breach

There were reports that the Russian hacker group LockBit was responsible for the ransomware attack and data breach at Evolve Bank. LockBit had claimed to possess Federal Reserve data and, when their demands were not met, released approximately 33 terabytes of data from Evolve’s systems. The group had allegedly touted their cache of Federal Reserve data, which was used to pressure the bank into meeting their demands.

In response to the reports surfacing about the Evolve data breach, Evolve Bank & Trust is actively informing affected individuals about the breach. The bank has started reaching out to impacted customers and financial technology partners’ customers through emails sent from . The communication includes detailed instructions on how to enroll in complimentary credit monitoring and identity theft detection services.

Steps Taken by Evolve Bank & Trust

The bank is undertaking a comprehensive response to this incident, which includes:

- Engagement with Law Enforcement: Evolve has involved appropriate law enforcement authorities to aid in the investigation and response efforts.

- Customer Communication: Direct communication with affected customers and financial technology partners’ customers is ongoing to ensure they are informed and can take necessary protective measures.

- Credit Monitoring Services: Impacted individuals are being offered complimentary credit monitoring and identity theft detection services.

- Continuous Monitoring: Evolve is closely monitoring the situation and will provide updates as necessary to keep customers informed.

Recommendations for Affected Customers

Evolve Bank & Trust advises all retail banking customers and financial technology partners’ customers to remain vigilant by:

- Monitoring Account Activity: Regularly check bank accounts and report any suspicious activity immediately.

- Credit Report Checks: Set up free fraud alerts with nationwide credit bureaus—Equifax, Experian, and TransUnion. Customers can also request and review their free credit report through Freecreditreport.com.

- Reporting Suspicious Activity: Contact the bank immediately if any fraudulent or suspicious activity is detected. Additionally, individuals can file a report with the Federal Trade Commission (FTC) or law enforcement authorities if they suspect identity theft or fraud.

Recently, Evolve received an enforcement action from its primary regulator, the Federal Reserve Board, highlighting deficiencies in the bank’s IT practices and requiring a plan and timetable to correct these issues. This breach highlights the importance of addressing these security concerns promptly.

Evolve Bank & Trust is known for its partnerships with several high-profile fintech companies, including Mercury, Stripe, Affirm, Airwallex, Alloy, Bond (now part of FIS), Branch, Dave, EarnIn, and TabaPay. The bank has also worked with Wise and Rho in the past, though both have since migrated to other banking partners.